Tax Rate Information

Lower Overall Tax Rate with VATRE Approval

With the passage of the VATRE, the overall tax rate (M&O + I&S) will be $0.0014 less than the 2023 rate of $0.9247.

Maintenance & Operations funds employee compensation and day-to-day operations.

Interest & Sinking funds are strictly used to pay off voter-approved bond debt.

GCISD Average Taxable Home Value: $485,386

With the average taxable home value in GCISD at $485,386, the savings due to the reduced overall tax rate would be $6.80.

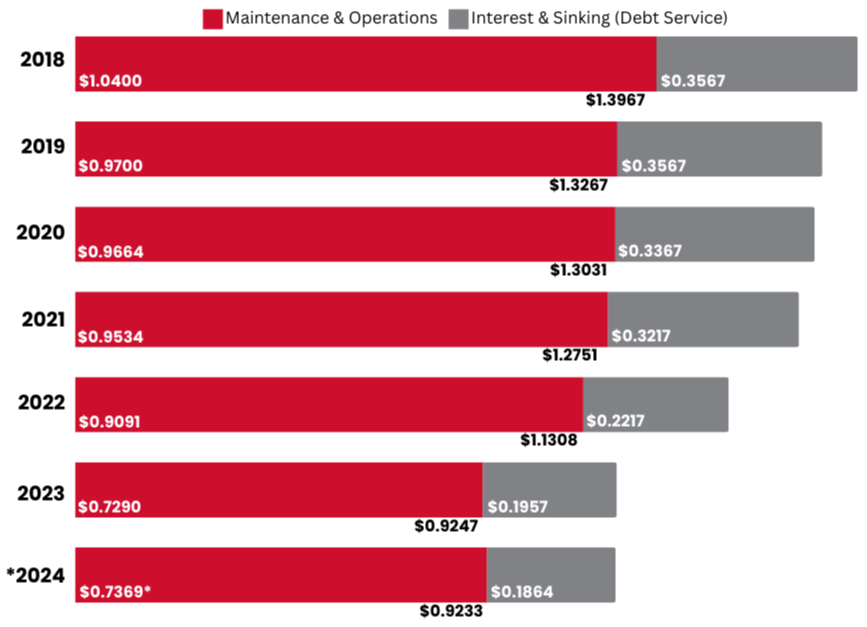

History of GCISD Tax Rate

The overall tax rate is 47.3 cents less than it was in 2018, which equates to $90 million of taxpayer relief.

This is the lowest overall tax rate in GCISD in more than 25 years.

Year | M&O | I&S | Total |

|---|---|---|---|

2018 | $1.0400 | $0.3567 | $1.3967 |

2019 | $0.9700 | $0.3567 | $1.3267 |

2020 | $0.9664 | $0.3367 | $1.3031 |

2021 | $0.9534 | $0.3217 | $1.2751 |

2022 | $0.9091 | $0.2217 | $1.1308 |

2023 | $0.7290 | $0.1957 | $0.9247 |

2024 | $0.7369* | $0.1864 | $0.9233 |